[Column] Weaknesses of Non-Fungible Tokens(NFT), Kim Seung Joo's Cryp…

본문

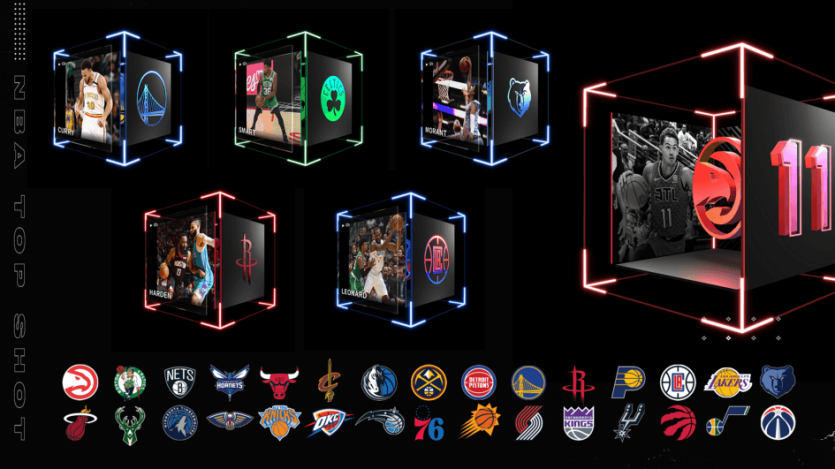

NFT is a system that stores the ownership (aka 'token') of digital files such as JPG, GIF, video, etc. on a blockchain to permanently preserve them in a state in which forgery and tampering is impossible, and to verify the ownership in a decentralized form. say that In addition, owners who purchase NFTs can also resell digital assets through transactions.

The reason why NFT is called 'Non-Fungible Token' is simple.

1 bit coin I own can be exchanged 1:1 with 1 bit coin someone else has. On the other hand, NFTs have different connected digital assets, so 1:1 exchange with other NFTs cannot be established. So, cryptocurrencies such as Bitcoin or Ethereum are called 'Fungible Token(aka ERC-20 Token)' and NFTs are called 'Non-Fungible Token(aka ERC-721 Token)'.

For example, on March 5, Jack Dorsey, CEO of Twitter, announced that he would sell the posts he first posted on Twitter in 2006 as NFT, recording an asking price of $2.5 million(about 2.84 billion won).

Jack Dorsey's first tweet still exists on Twitter and can be seen by anyone, but only the owner of the NFT has the right to own and dispose of that tweet as a digital asset.

Some may question why it is necessary to use NFTs when proof of ownership of assets is possible with existing paper contracts. That's right.

The advantage of using NFT is that it can promote transactions of digital assets by linking with smart contracts to enable peer-to-peer transactions and partial distribution of ownership by dividing tokens as 1/n. In addition, since it is stored on a decentralized blockchain, concerns about loss of ownership can also be reduced.

NFTs do not have only advantages. There are obviously things to be aware of.

First is the issue of intellectual property rights. Someone can arbitrarily create and sell NFTs for other people's digital assets that they did not create, and the ownership-related details displayed on the NFTs may differ from what the buyer originally thought.

The second is that the NFT itself can be stored on a public blockchain and permanently preserved, but the actual original digital file is not.

There is a risk that original files stored on a general server (IPFS, to be exact) can be deleted at any time due to hacking or careless management. In addition, due to the digital nature of the original file, unauthorized copying is easy and there is no difference between the original and the copy, so it may be less rare than paintings or sculptures where the concept of original exists.

Lastly, like cryptocurrencies such as Bitcoin, NFTs are not environmentally friendly. It is generally known that one cryptocurrency transaction consumes the energy equivalent of 700,000 credit card transactions. NFTs consume much more energy than cryptocurrencies as they require energy at every stage of creation, purchase, sale, resale and storage.

NFTs are clearly another great example of blockchain's potential. In fact, according to BNP Paribas, France's largest financial company, global NFT transactions increased to $250 million last year, nearly quadrupling compared to 2019.

Although the amount of NFT transactions is rapidly increasing, there are also concerns about this.

Recently, it was confirmed that the person who bought the NFT work, which sold for the highest price ever at a digital art auction of $69.3 million(about 78.75 billion won), was none other than a senior executive from Singapore working at an NFT investment company. There is also a warning that big players in virtual assets (cryptocurrency) are raising bubbles.

Now is the time to take a cool approach to NFTs.

Source: Coindesk Korea (http://www.coindeskkorea.com/news/articleView.html?idxno=73064)